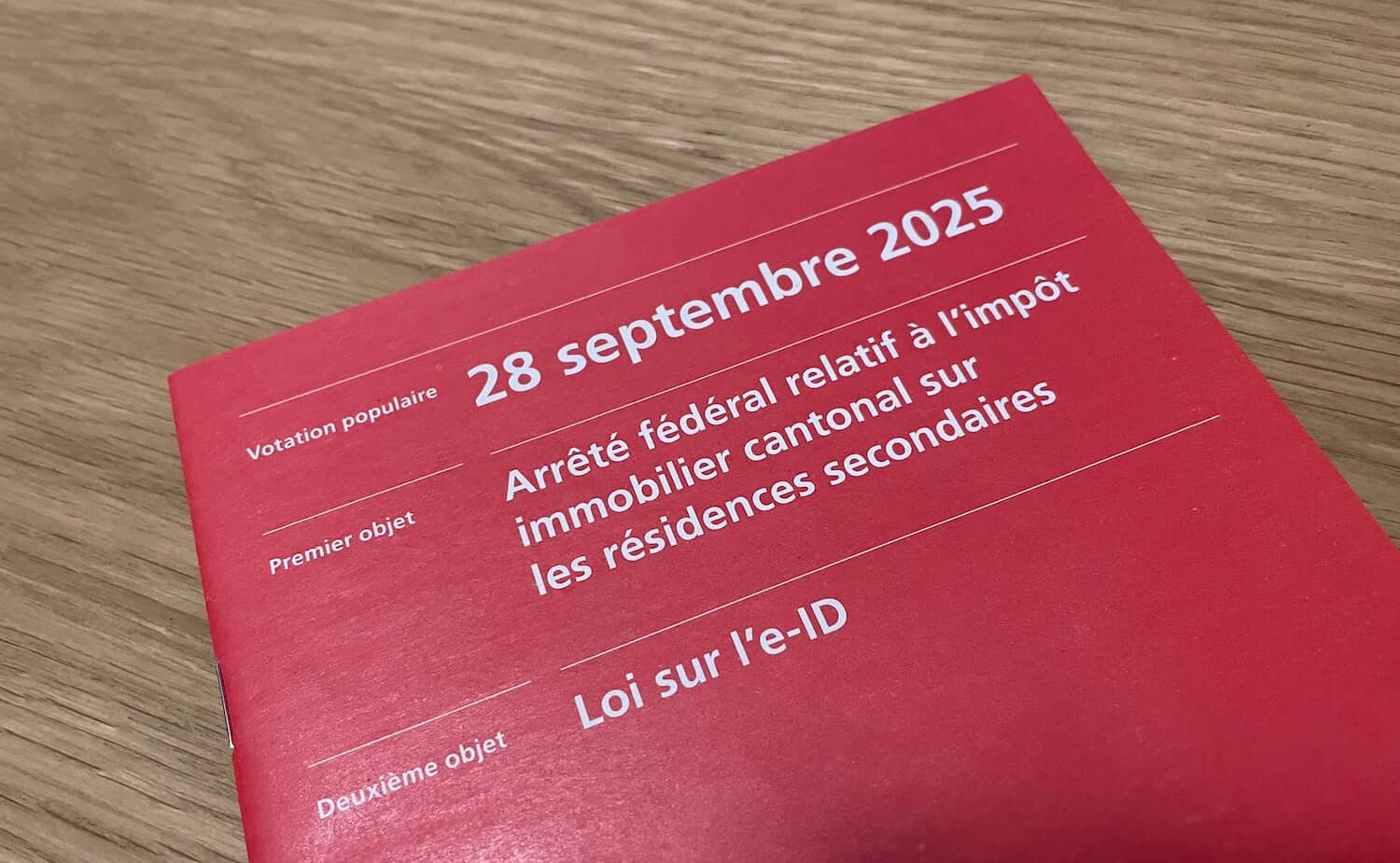

On 28 September 2025, Switzerland voted on two contentious matters: a state-run electronic identity (e-ID) and a revamp of property taxation. Both were approved, though one only just.

The e-ID Act scraped through with 50.4% in favour and 49.6% against – narrower than polls had suggested. And, only 7.5 out of 26 cantons were in favour – Switzerland has 20 full cantons and 6 half cantons. Because this vote aimed to change a federal law rather than the constitution, it does not require a double majority – a majority of voters and a majority of cantons.

The scheme, free and optional, will be issued by the state. A similar plan was rejected in 2021 amid fears that private firms would hold citizens’ data.

The new system will allow people to prove their identity online and off, from accessing public services to opening a bank account or buying alcohol. Each e-ID will be tied to a single smartphone; changing devices will require re-registration.

Privacy dominated the debate. Critics warned that a voluntary scheme might become mandatory in practice, penalising those without smartphones. Authorities stress that traditional ID cards will remain valid.

A tax shift for homeowners

Voters were clearer on taxing second homes, which passed with nearly 58% in favour. Although there was a strong linguistic divide – all French-speaking cantons were against it, while all the rest, with the exception of Basel-City, were in favour.

Acceptance clears the way for abolishing imputed rents, a rule requiring homeowners to add a fictitious rent to their taxable income, while deducting mortgage interest and upkeep costs.

The removal of imputed rent will end tax deductions for interest and home maintenance. The Federal Council will now set the timetable for implementation. While no definitive timing can be given, the Swiss Homeowners’ Association expects implementation no earlier than 1 January 2028, to give cantons time to adapt their laws and update administrative processes.

For more stories like this on Switzerland follow us on Facebook and Twitter.